What is Your Business Exit Strategy?

– Part 1 of a 4 Part Series on Exit Strategy

All business owners are linked by one simple fact – when they decide to exit their business they want to make sure they get the best deal. Getting the best deal involves planning for the final exit and presenting the business in the best possible light.

Exiting your business should not be seen as a game of chance. Proper planning allows you to remain in control of any process. It allows you to focus your business on the most important value creation strategies prior to your exit. At some point in the future every business owner will inevitably exit their business. What’s Your Exit Strategy?

What is an Exit Strategy?

An exit strategy is a plan executed by business owners, investors, or private equity firms to liquidate their position in a financial asset upon meeting certain criteria. An exit plan details how an investor plans to get out of an investment.

An exit strategy can start at any time, but the sooner the better if it is to have an impact on the external valuation achieved. For many owner managers, exit planning is often started too late. Fortunately the benefits of early exit planning have become more apparent and fewer and fewer business owners are falling into this trap. One example of this is that many owners have recently been forming MBO teams and combining them with private equity partners. They know that formulating a credible exit strategy usually takes place before anyone invests any money or capital. Such MBO teams know that one key benefit of formulating an exit strategy 12-24 months prior to an exit is the time doing so allows an owner to create value. The owner can focus on improving areas in the business that are key value drivers to a buyer. This usually includes growing the business, streamlining processes, and training key employees. Generally speaking, the longer an owner has to create value for the business, the greater the benefit. But one thing is certain- by identifying and implementing a value creation strategy, the final exit will be improved.

Key Areas to Address:

There are several key areas to address when formulating an exit strategy:

- The exit alternatives and which are best for the business and its owners?

- The current value of the business and how it compares with price expectations?

- What are the valuation gaps?

- The future prospects for the business and the key threats to a successful exit?

- What does the business need to look like to be attractive to an external buyer?

- What does the business need to look like to be attractive to an institutional investor?

- Would buying the business, via MBO, appeal to the existing management team?

- What are the opportunities for improving the value of the business?

- How much time is available and how may improvements be achieved?

- How should the exit strategy be implemented?

Formulating an Exit Strategy

There are many reasons why owners of businesses start to think about seeking an exit:

- The owner may be seeking retirement

- For an MBO or MBI the exit is part of the original investment plan

- The business may require significant investment

- A sale of all or part of the business (assets or equity) may best mitigate risk

- The owner may feel the market is as good as it is going to get

- Market conditions could deteriorate

- Key employees may be seeking to retire and would be difficult to replace

- For large corporations, particular subsidiaries may become non- core

- Changes in group strategy may be required

- There may be a need for additional cash

How Can Owners Exit Their Businesses?

There are an increasing number of ways for owners to exit their businesses:

- Financial Investor – a private equity firm purchases the business

- Strategic – the business is sold to another company either in the same

.00markets or to a buyer that wishes to enter the target’s markets or

.00extend its business into the target products. - IPO – the company’s shares are floated on a public market providing

.00a partial or full exit and a route to full exit in the longer term while

.00benefiting from future increases in value. - MBO – “Management Buy Out” acquisition of a business by its existing

.00management team from its existing owner. - Recapitalization or Cash Out – the owner takes out some cash in exchange

.00for part of his equity but retains an ongoing stake in the business, often

.00alongside management, allowing a future sale at a higher price in the future.

.00Such a transaction is often funded by a bank and/or private equity firm.

In deciding on the best exit strategy for a particular owner the starting point is to identify what the shareholders/other owner objectives are. For example, a weak management team may restrict opportunities to do an MBO, but may be less problematic to a competitor who has their own management team. In such a case, the first step in formulating an exit strategy is to conclude what your realistic exit options might really be.

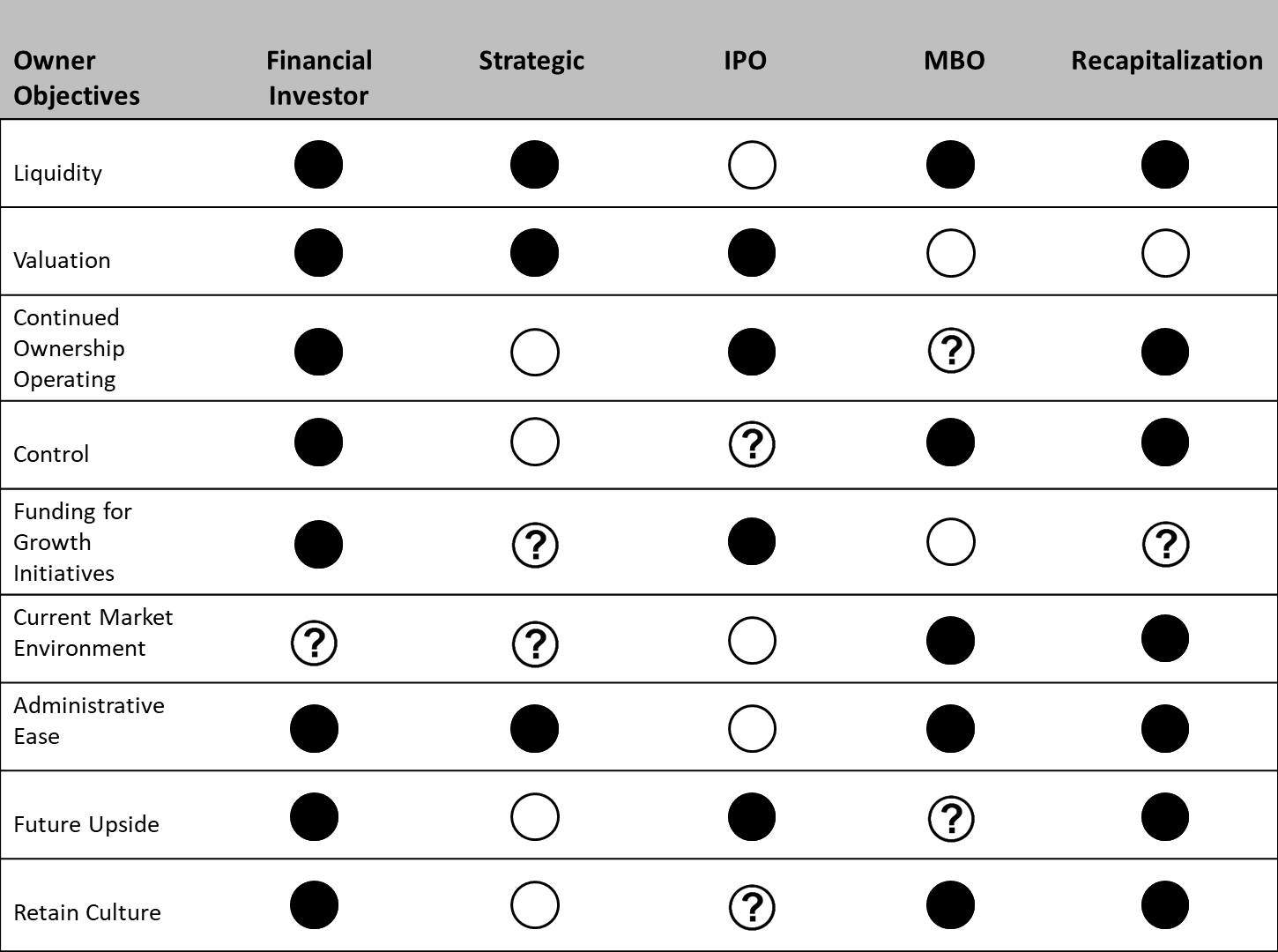

This table illustrates the key owner objectives and how they align with the strategic exit options available: