Considering a Management Buyout (MBO)?

– Part 2 of a 5 Part Series on MBOs

How are MBOs Structured and Financed?

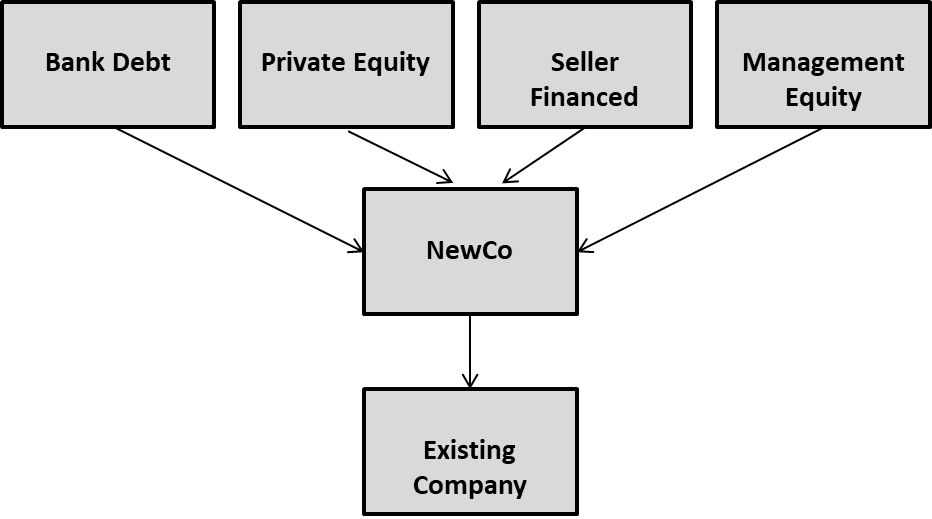

For the sole purpose of buying the company and financing the purchase, management and the financiers often create a new company (“Newco”). In the most common structure, Newco acquires 100% of the shares in the target company and thus becomes the holding company. Newco then raises different types of financing from different sources.

Most managers do not have the financial resources to purchase their interests so financing to support an MBO normally comes from banking and/or private equity institutions in the form of debt and equity respectively. The management team is expected to show its commitment by investing a significant sum relevant to personal circumstances, which may well be a fraction of the total financing raised to buy the business. In addition, the seller may be willing to defer some of the consideration for the business through a loan or an earnout agreement, which have become a regular feature in the current market.

Typical sources of financing are:

Debt and working capital facilities (credit lines) are typically provided by a bank or an asset-based lender (“ABL”). Equity most commonly comes from a private equity firm. The least expensive form of financing is bank debt, particularly if there is sufficient and good quality security available to support it. A bank typically provides up to 60% of total financing needs. The bank will have security over the assets of the business acquired and will require to be repaid in priority to the private equity firm. However, it is normally the case that the value of a business exceeds its debt capacity, in which case some form of equity financing is required to bridge the gap.

The private equity firm typically provides up to 50% of the financing required for the MBO although it can be up to 100% in certain circumstances. It will “bridge the gap” between the other financing sources and the price. It will stand behind the bank and seller and therefore require a greater level of return. It will usually achieve this by subscribing for a percentage of the common and/or preferred shares of the business, alongside management. The remainder of their financing will typically be invested as debt.

Financing from the seller is usually a matter of negotiation. It can be in the form of earnout agreements, loans, or equity. Regardless of type, the financing is generally in the same proportion of ordinary shares and loans as what would be provided by a private equity firm. Seller financing can be useful in bridging any price gap. However, some sellers may appreciate the opportunity to reinvest part of their proceeds in the new entity which would provide an ongoing involvement and upside potential. This continuation of emotional ties, and the possibility of a share in higher proceeds further down the line, can be a strong influencer for sellers who choose an MBO over an external buyer. In some instances, the seller may replace the private equity firm entirely. It should be noted that alternative sources of equity financing also include government funds and investments by angel investors.

The mix of financing will depend upon the particular circumstances of the deal including the growth potential, the stability of profits and cash flows, and the asset security. The bank obtains its return by charging interest and receiving repayment of capital in priority to the equity investor. The private equity firm could structure its investment as a combination of debt and equity, with the debt attracting interest and being repayable behind the bank but ahead of the equity. The private equity firm makes the bulk of its return from its shares alongside the management team when the business is sold, hopefully for a substantial profit. The management team is likely to invest the smallest amount but stands to make the greatest capital gains. The financial characteristics of an MBO therefore present management with the opportunity to acquire the business they are running, financed largely by money provided by external financial institutions, with repayment of that finance flowing from the profits generated by the business acquired and/or an ultimate sale of the business.

Do I need all these Sources of Financing?

The simple answer is “no”. Some transactions do not lend themselves to large amounts of debt. Some sellers are unwilling to defer some of the proceeds in the form of a loan or earnout agreement. Sometimes, the amount of debt and seller financing that is available alongside the investment from management is sufficient to purchase the business equity or assets so no private equity is required. The most appropriate structure depends on multiple factors. Spend time with your advisers and financiers to best structure your deal.

In short, with MBOs the management team commits the smallest quantity of the financing, but in return it provides the know-how the banks and private equity firms cannot. This is why a high quality management team is vital to successfully attracting financing.

Do I need an Advisor?

Successfully negotiating the MBO process often comes down to appointing the right team of advisers. Once the initial MBO interest has been established, it is essential for the management team to consult an experienced corporate finance adviser. Managers are unlikely to be involved in more than one MBO in their lives and appropriate advice at an early stage is sensible when embarking on such a complex and sophisticated transaction. In addition, the management team will find itself under immense pressure and severe time constraints during the process, as well as having to fulfill its continuing management responsibilities. An adviser should be able to estimate management’s chances of success at the outset and save a lot of time and energy.