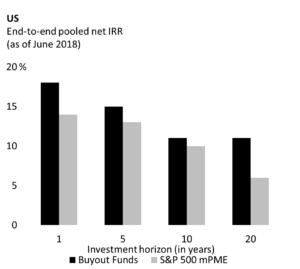

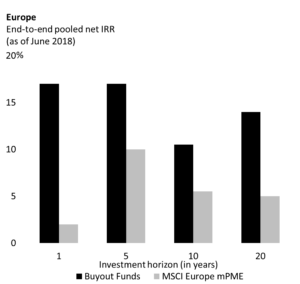

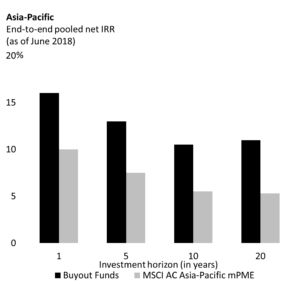

Private Equity Outperforms Public Equity

Private equity has nearly always demonstrated that it’s an asset class which produces steadier, more reliable returns than those of public equities. Notice how after a period of heavy stock market volatility around the world, buyout funds usually continue to outperform public equity markets in all major regions, over both short and long time periods.

Consider how wildly public equity valuations have swung in recent years. In 2016, European stock markets tanked on the Brexit vote, while Asian markets declined due to a correction of the bubble in China’s stock market. In 2017, markets turned around as a synchronized global economic expansion resulted in gains across regions. In 2018, European public market performance was anemic, while Asian markets were weighed down by trade tensions and slowing growth in China. In the US, a multiyear bull-run came to an abrupt halt at the end of 2018 as an array of concerns began to spook investors.

Private equity, meanwhile, kept outperforming. Using the modified public market equivalent (mPME) metric developed by Cambridge Associates, which replicates the timing and size of PE cash flows as if they had been invested in public equities, it is possible to make an apples-to-apples comparison of PE returns with public equity returns. By this measure, which looks at end-to-end pooled net IRR, buyout funds outperformed the public markets across all regions, and during a variety of periods ending June 2018. Here is the most recent data available from Cambridge Associates: